As a consultant, I usually get called in to help when a startup realizes they have a problem—in particular, a problem with customer retention (or it’s inverse, customer churn). In preparations for a board meeting, the executive team checks the numbers they commonly report on and realizes that, for some reason, they’re not hitting revenue or retention goals. They know they’re losing too many customers, but they don’t know why.

Most leaders I work with hope for an easy fix, but the reasons customers choose to leave are many. And unfortunately, most businesses don’t have the data to look back at what happened. So they focus their attention on fixing some of the most glaring organizational issues and hope things will turn around before the next big board meeting.

As someone who has worked with my fair share of startups looking to grow fast, I can tell you that addressing customer churn is one of the most foundational elements of growth and that simply hoping for the best will only get you so far. That’s because, as startups grow, the pain of losing customers compounds.

Not convinced churn is something your business needs to worry about? Even if customer happiness seems to be through the roof, allow me to share five key reasons why churn rates should be on your radar and why you should view fixing this problem as an opportunity.

What is Churn?

Before we get too far, let’s start with some simple definitions. The terms “churn” and “retention” can mean different things to different people. For simplicity’s sake, when I talk about them in this article, I simply mean logo retention. If you won 500 customers, or logos, last year, how many of them remain customers this year and how many left?

Where the meaning of customer churn gets blurry is in the calculations. You can look at the sheer number of customers that left or the dollar amount you lost as a result of their leaving. You can calculate gross churn or net churn. At last count, there were over 40 ways to calculate retention rates—an insane amount of complexity.

So for today, we’re keeping things simple. When we talk about retention, we’re simply taking how many customers your business had at the start of a period and comparing it to how many remained at the end of that period. When we talk about churn, it’s the inverse.

Simple Customer Retention Rate Formulas

If you haven’t calculated churn or retention before, here are the simplest formulas out there.

X = # of Customers at Beginning of Period

Y = # of Customers at End of Period

Retention = Y / X

Retention shows the percentage of customers you kept through the period. If you started the quarter with 750 customers and ended it with 700 of those, your retention rate would be 93%.

Churn = (X-Y) / X

Churn shows the percentage of customers you lost over the period. Using the example above, your churn rate would be 7%.

Of course, your business can (and should) be gaining more customers than it’s losing, so you can see why these calculations can get a bit murky. It’s not as simple as comparing your total customers from one moment to another. It’s about comparing how many of the original bunch have stayed.

Put more simply, recall that you had 750 customers at the start of the quarter and 50 of them left. If you closed 250 more customers throughout the quarter, you might think, “Great! I don’t have a churn problem. I ended the quarter with more customers than I started with.” But you still lost 50 customers, and you’re no closer to understanding why. So you’ve got to find out, of those customers you started with, how many stayed—and how many left.

When Should I Start Tracking Churn?

Now, before you start to worry too much about your own customer retention metrics, keep in mind that this calculation of customer churn is intended to help companies with hundreds or thousands of customers analyze trends.

If your business is new and growing, you should still pay close attention to customers leaving, but know that their reasons for doing so are likely due to the fact that you haven’t yet found product-market fit. In this case, you’re probably better off focusing on honing your core value proposition and go-to-market strategy.

Similarly, if your business runs on an enterprise model and you have fewer than 100 customers, these exact metrics might not be helpful. Think about it: if you have 50 customers and lose three of them, your churn rate would be 6%, a rate similar to the example above. And yet, that rate is likely dependent on the decisions of three individuals. Maybe it’s indicative of larger problems in your organization, maybe not. The sample size is just too small to tell. Here you’ll probably want to spend less time worrying about the calculations and more time gathering qualitative data through established customer relationships.

Now, assuming you have a large enough pool of customers to draw from, there are several ways that calculating churn can have a positive impact on your business. Let’s dive into them.

1. Churn Affects the Bottom Line

You might be thinking, “Duh, Dan. Losing customers means losing money.” But do you know how much money is on the table?

Let’s start with a few interesting statistics. According to Bain & Co., increasing customer retention rates by just 5% can lead to a profit increase of 25% – 95%. On top of that, the Harvard Business Review found that attracting a new customer costs five times as much as keeping an existing one.

That’s what customer retention comes down to, really. For every customer you lose, you need to go out and replace them with a brand new customer, which will require that you spend money on marketing, sales, and onboarding all over again. The ROI of investing in churn reduction far outpaces the ROI of landing a new customer.

David Skok demonstrates this problem well—and in great detail—when analyzing the cost of hiring new sales talent. He uses a complex model to help businesses uncover their break-even point for new sales hires, which he finds to be about 21 months for an average SaaS business. To reach this calculation, he assumes a relatively modest monthly churn rate of 2.5%. Bumping up that churn rate even slightly in the calculations can push out the payback period to over three years!

As a founder, you could find yourself in a real cash flow crunch if you scale up marketing and sales teams early but your customers don’t stick around long enough to make your business model work.

2. Churn Slows Growth Rate

Most startup founders share a similar goal: they want to grow their businesses thoughtfully, and they want to do it quickly. The race to become a market leader means accumulating a long roster of happy customers that advocate for your business before anyone else wins their affections.

In this race to the top, the comparison between winning new sales and retaining existing customers becomes the SaaS version of the phrase, “Offense wins games; defense wins championships.”

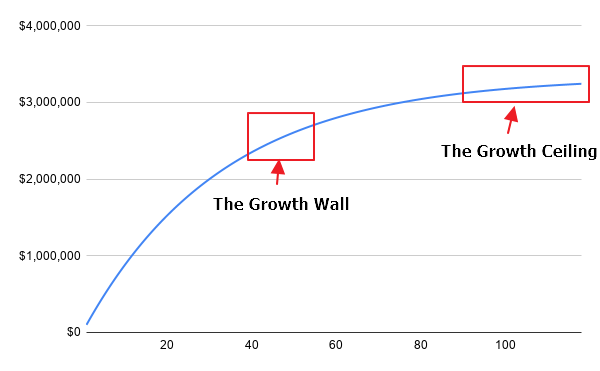

Here’s how this concept plays out. As you win more and more customers, you might hit a growth wall if your churn rate is too high. A growth wall is like a leaky bucket. Even as you add more to it through new ARR, you’re always steadily losing. In order to keep the bucket full, you have to add more than if you were able to plug up some of those holes. For most companies, this can be extremely difficult to maintain and growth begins to slow, or hit a wall.

Growth walls are an early warning sign for something you really don’t want to see: the growth ceiling. When businesses hit their growth ceiling, they begin to run in place. They lose customers as fast as they bring them in, effectively stopping growth in its tracks.

When customers are retained in high volumes, growth is catalyzed because your team does not have to make up for what’s been lost. Instead, you can focus the business’ energy on the future.

3. Investors Care About Churn

If you’ve gone through a fundraising round, you likely had to pull a lot of data in preparation for pitch meetings. Investors are a numbers-diven group, and there are some that matter more than others. Churn is chief among them.

Investors care about churn, not necessarily because they want to dive into the inner workings of your customer service processes, but because they look at churn as a proxy for product-market fit.

There are two sides to product-market fit: a large enough market to succeed and a product that satisfies the need of that market. If customers are leaving in droves, investors might question whether your product really satisfies the need of your chosen market. If they’re unsure, they might consider your business too risky to invest in.

4. Internal Employee Morale Will Suffer

Employees are often an afterthought of churn, if they’re considered at all. But that’s a shame if you ask me.

Startups are built on employees buying into a founder’s vision and helping to bring it to life. When they become overrun with angry, grumbling customers, it’s sure to impact the way they view this vision and the possibility of achieving it.

And don’t forget the example I shared before. It takes time to onboard and train employees, for the cost of their employment to be repaid. A happy team that’s bought into your vision will help you achieve your lofty goals for growth more quickly. Replacing your top performers frequently will only extend the amount of time it will take to do so.

5. Churn Is an Opportunity

This last point is an important one—and it’s one that should excite you! Every business looks for opportunities to get into the heads of their target customers, to understand them better.

No business will satisfy every single customer that comes in the door. That’s just reality. But when customers leave, you can choose to be frustrated and to label them vaguely as “not a good fit” for you. Or you can dig into why they’re leaving with an open mind.

When customers leave for similar reasons, it’s the surest sign that your business is not aligned with what the market values. This information should then inform every aspect of your business—from what you offer to how you market that offering.

Churn is the market research you would have paid an arm and a leg for when you started out, and it presents an opportunity for you to turn grumpy customers into loyal, ardent supporters—if you address it head on. Showing your customers that you value their feedback and you’re willing to act on it can create more goodwill than if things had gone smoothly in the first place.

The Harvard Review states, “Every customer’s problem is an opportunity for the company to prove its commitment to service—even if the company is not to blame.”

Take advantage of this opportunity to get to know your customers even better and they will thank you for it.

What To Do If There’s a Problem with Customer Retention

So you’re convinced now, right? Churn is an important facet of your business and one that you should track diligently. Great!

What do you do if you realize you’ve got a customer retention problem? It’s easy to get lost in sophisticated churn calculations. You can spend weeks trying to dig into the problem, gather data, and perform complex math.

Before you do all that, there’s one thing you should do immediately: start recording data. If you don’t have a system for documenting the reason a customer leaves, put one in place on day one. This might be a form that you add to Salesforce or Zendesk. But if the best thing you can do is start a shared spreadsheet, do that.

The only way to turn churn from problem to opportunity is to track as much data as you can and to use that data to drive improvements.

That kind of data is also what helps consultants like me to hit the ground running. My job is often to do the complex analysis that few on staff would have time to undertake. It’s to give your customer retention questions my undivided attention and to work side-by-side with leadership to find solutions.

If you’re ready to tackle customer retention, let’s talk. I’m ready to help you turn on-the-fence customers into loyal brand advocates and to help you achieve your goals.