My latest read is Anthony Ulwick’s book, What Customers Want: Using Outcome-Driven Innovation To Create Breakthrough Products and Services. The Jobs-To-Be-Done (JTBD) module in the Product Strategy course I help teach at Kellogg inspired me to pick it up. I wanted to learn more about how Ulwick teaches this theory as he’s one of the fathers of the JTBD framework and see how I could apply it to the world of SaaS pricing.

Ulwick, the founder of Strategyn, shows how companies can apply the JTBD theory, calling his approach Outcome-Driven Innovation* (ODI). Ulwick believes that if you know what metrics customers will use to measure success, you can design the product around that set of metrics and have a more predictable innovation process.

As I read the book, I realized that putting the JTBD theory into practice with ODI can help you define SaaS pricing and packaging to grow your revenue, increase your ACV, and accelerate your customer acquisition. While Ulwick focuses on ODI mainly as a tool for improving innovation, I believe that it helps companies with SaaS pricing based on these fundamental principles:

- Understanding value to the customer is a crucial step in SaaS pricing

- Customer segmentation is the first step to a well-run pricing exercise

- ODI helps you make better customer targeting decisions

- Value communication is as vital in value-based pricing as price setting

Let’s dive into the core of what Ulwick outlines in the book.

What is Outcome-Driven Innovation?

Instead of crafting products based on random customer suggestions, unfounded inspiration, or competitors, ODI implores us to focus on the results customers are looking to accomplish. Doing it this way enables you to build successful products.

Customers look for products to accomplish tasks, solve their problems and achieve their desired results. They subconsciously use a set of metrics to decide if a product is good or not — this is what you should figure out before you even begin to create your product.

It’s important to note that these metrics:

- Are defined by your customers, not by you or the people in your company

- Involve specific criteria that help customers judge your product’s value

- Relate to the job or process customers are trying to get done

Being customer-driven is no longer enough. Companies must become outcome-driven. Truly successful SaaS businesses focus on the outcomes their customers desire. This way, they can proactively create solutions that their customers will value.

Why B2B SaaS Founders Should Care About ODI

Most SaaS Startups Fail

92% of SaaS companies die within the first three years despite moderate growth. So if you want to accelerate your growth and be part of the successful 8%, you should shift your gears and start focusing on ODI today.

Of course, SaaS founders are smart enough to do market research before developing a business. It’s just that most don’t know how to elicit the most relevant inputs from their customers.

Founders also spend incredible amounts of time debating how to capture market information (e.g., analytics, interviews, observation, Voice-of-Customer platforms) when they should spend their energy figuring out the right kind of information to collect. Often, what customers say is not what they mean.

SaaS Companies are Led Astray by Customer Feedback

It’s important to take customer feedback with a grain of salt. More often than not, there are undisclosed caveats behind each statement.

The literal voice of the customer does not translate into accurate data. Easy-to-use can have many different definitions. For example, it may mean intuitive for one, accessible for the on-the-go customer, or well-designed for the aesthetically-inclined customer.

The voice of the customer approach to innovation is tricky. These inputs to the innovation process are vague, but customers are not to blame. While customers are willing to share ideas, you can’t expect them to tell you what valuable products to create. Plus, customers don’t naturally explain how they will judge the value of your product.

It’s not the interviewer’s fault, either. Interviewers rarely know the correct data they need. They let the customers express themselves in a convenient language. Without understanding what customers mean and knowing what’s most important to them, you might build the wrong products, make bad pricing decisions, and waste funding.

Market research can provide you with the correct customer information needed for pricing and innovation — as long as you know the kinds of info you should be collecting.

Lack of Precision in Research Inputs Leads to an Intractable Innovation Process

There are five types of information researchers often get from customers during the requirements-gathering process:

- Solutions – Describe the tangible features customers want to see in a product.

- Design specifications – Are statements customers make about your future product design, like button color, speed, and workflow steps.

- Customer needs – Are general descriptions of the overall qualities of a product. They’re typically adjectives like reliable, effective, or robust.

- Customer benefit statements – Are distinct advantages customers would like in a new product. Typical examples are words or phrases like convenient, faster, better, and more affordable.

- Opportunities or problems – Are sets of circumstances that the customer thinks can be improved. However, precision in the definition of either opportunity or problem is lacking.

These inputs can lead you down a sad path when performing customer research. Misleading inputs at the beginning of the customer research lead to an undebuggable innovation process.

Instead, ODI encourages us to look for desired outcomes. Outcomes are the metrics customers use to measure how well a product performs a job.

Three ODI Principles SaaS Founders Must Know

Principle #1: Customers Buy Products and Services to Get Jobs Done

In the outcome-driven model, the focus is not on the customer. It’s on the job that customers want to accomplish. Customers bring products into their lives to complete a job, giving us an answer to the ever-elusive question of “Why do customers buy?”

In the JTBD Framework, there are three types of jobs:

- Functional jobs – These jobs define the tasks customers aim to do.

- Emotional jobs – These are the tasks that relate to achieving personal goals. Ulwick splits Emotional jobs splits into

- Personal jobs, which explain the way people want to feel in a given circumstance, and

- Social jobs, which explain how people want to be perceived by others

Principle #2: The Types of Data You Capture Matter More Than How You Collect Them

How you collect customer information matters less than the types of data you’re gathering. It’s more important to direct your energy into collecting the correct type of data: jobs, outcomes, and constraints.

First, company’s must understand the jobs customers want to get done. As outlined in the previous section, jobs can be either functional or emotional.

Next, company’s need to understand the outcomes that customers are trying to achieve. There are three components of an outcome:

- The desired direction for the metric – You can efficiently describe most metrics by two direction words: minimize and increase. You may be tempted to use variety in your descriptions of metric directions by using phrases like reduce, eliminate, or prevent. However, these words introduce an unintended bias. Experience has shown that these words imply exaggerated or disproportional effects, introducing unwanted variability in customers’ minds and your research output.

- The unit of measure – People have their own set of metrics that they use to judge whether a specific product gets the job done or not. For example, customers may care about time, cost, or risk.

- The desire – The desired outcome relates to the result that customers want to achieve.

For example, an outcome statement might be something like:

Minimize the time it takes to discover errors in submitted invoices.

- Minimize – a direction

- Time – a unit of measurement

- Discover errors in submitted invoices – a desire

Finally, company’s should understand the constraints customers face in getting a job done. A constraint is a problem that prevents a customer from completing a job in total or in part. It indicates why a customer cannot perform a task or adopt a product. Constraints can be physical, regulatory, or environmental contexts that the customer faces, and removing these constraints presents a growth opportunity.

Principle #3: An Unmet Outcome, Job, or Constraint Creates an Opportunity for Growth

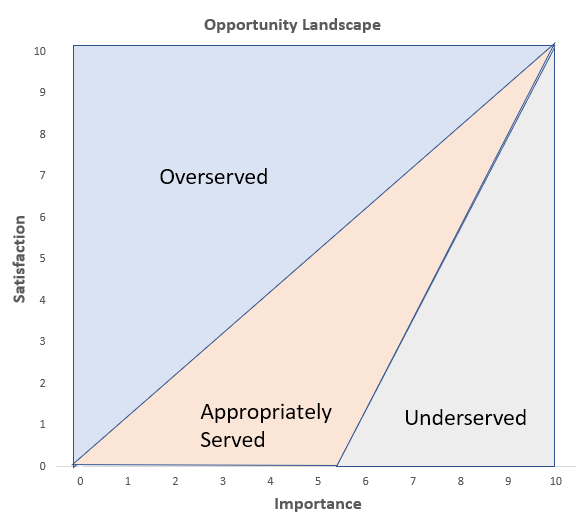

An opportunity is an outcome, job, or constraint that is underserved. To recognize these growth opportunities, consider the Opportunity Algorithm.

The Opportunity Algorithm leverages two fundamental concepts from ODI research on customer jobs: Importance and Satisfaction.

- Importance is the relative importance of completing the job for a customer.

- Satisfaction is the customer’s current satisfaction level with completing a job.

I won’t get into the specifics of measuring Importance and Satisfaction here, but Ulwick uses a 1-10 scale for both dimensions to develop the Opportunity Score per job. Once you have the data, you can calculate it using this formula from the book:

Opportunity = Importance + Max (Importance-Satisfaction, 0)

Opportunity scores per job outline how attractive investments are for helping customers with specific jobs. As a rough outline, Ulwick suggests four categories of opportunity scores:

- 15 = extreme areas of opportunity

- 12 to 15 = “low-hanging fruit” opportunities

- 10 to 12 = opportunities worthy of consideration

- < 10 = unattractive opportunities

The chart shows you the most exciting opportunities that you can invest in for growth. When a critical outcome is underserved, you have a chance to fill that gap.

What Do The ODI Principles Have To Do With SaaS Pricing?

Understanding Value To The Customer Is The First Step In SaaS Pricing

A precise definition of value to the customer allows for Economic Value Analysis, a critical step in pricing. You can identify value drivers and determine how much value is created for customers, which provides the area of opportunity for price setting.

The best opportunities are jobs that are important to customers but are not satisfied by existing products. These two questions can help you assess the opportunity for pricing power by investing in solving specific jobs.

- Are these desired outcomes vital to your customers?

If an outcome is unimportant, customers will not see the point of getting that job done. So making a product that addresses it will be a useless investment as customers will not pay for it.

2. Are there existing products or services that can fulfill these desired outcomes?

If other products satisfy an outcome, this is likely an overserved area. When customers are already satisfied with their outcomes, they’re unwilling to pay for another product that can satisfy them more. At a minimum, the market has already set the price for completing the job to a maximum level of satisfaction.

To build software that people will be willing to pay for, focus on essential outcomes that aren’t satisfied by existing solutions.

Customer Segmentation is The First Step to a Well-run SaaS Pricing Exercise

Effective customer segmentation creates a group of customers that:

- Has discrete underserved or overserved outcomes

- Is large enough to be worth attention and investment

- Is homogeneous

- Matches your firm’s strategy and competencies

- Can be reached via marketing and sales efforts

As I’ve discussed previously, businesses traditionally have tried to segment customers by:

- Products they buy

- Demographics/firmographics (e.g., business size)

- Psychographics

- Technology adoption attitudes

Sure, the traditional ways are convenient for the company and practical for marketing or sales purposes. However, they don’t bring together customers that offer the company the most significant opportunities. You can’t use demographics alone to group customers with unique underserved outcomes because demographics only tell you “Who customers are,” not “What customers want.”

The better way to do it is by using the opportunity score and outcome as the segmentation variables. When you segment based on these two factors, you create segments that represent valuable opportunities. This approach allows effective targeting, positioning, messaging, and pricing decisions.

ODI Helps You Make Better Customer Targeting Decisions

Four segment-specific targeting strategies and rules have proven effective:

- Identify opportunities that cover multiple outcome-based segments

- Build a single platform for a variety of segment-specific solutions

- Pursue the least-challenging segment first

- Target segments that represent attractive price points

SaaS founders often find it hard to formulate an effective competitive and pricing strategy. That’s because they don’t know which customer outcomes are underserved by their products and competitors. Customer targeting is essential to profitability because not all customer segments value your product the same way. Remember, “there are riches in the niches.”

Value Communication is as Crucial in Value-based Pricing as SaaS Price Setting

SaaS teams that don’t understand opportunities for serving customer outcomes are more likely to create messaging that doesn’t resonate with their customers. Instead, they are likely to develop messaging around outcomes customers are already satisfied with, preventing them from communicating the product’s true potential. ODI helps you create more compelling messaging for your SaaS product based on the value it provides.

Jobs-to-be-done includes both emotional and functional jobs. Understanding your industry and product category can help decide whether to highlight functional vs. emotional outcomes in your messaging. For example, customers purchase beauty and cosmetic products to get functional and emotional jobs done. However, they’re often mature product categories with relatively simple functions, making it challenging to differentiate one item from another in terms of functionality. Thus, manufacturers promote their products using emotional hooks to build and maintain brand loyalty. On the other end of the spectrum, SaaS products have many functional dimensions, allowing firms to differentiate them using functional outcomes.

That said, you should base your SaaS messaging strategies on the functional jobs your customers are trying to achieve. Only move toward an emotional appeal once the market satisfies the product category’s functional aspects.

B2B SaaS Pricing and Packaging Starts with Understanding Customers’ Jobs-to-be-Done

SaaS founders are listening to what their customers have to say. However, as the ODI process shows, knowing what to listen for is far more critical. To find out what your customers want, focus on the outcome they want to achieve—not on what they say.

*Outcome-Driven Innovation is a registered trademark of Strategyn LLC.