Most personas are eye-rollingly useless. Product Managers usually create these personas to satisfy Agile’s user story framework, adding nothing (or even causing harm) to the process of creating breakthrough products and offers.

The managers who create these useless personas take their first misstep in selecting the variables that form the base of the persona. The most commonly chosen variables don’t create personas with meaningful differences in purchasing or usage behavior or help categorize customers’ suitability for a company to target and serve—most managers base personas on demographic (B2C) or firmographic (B2B) variables. Companies have realized that personas created from these variables do not isolate differentiated customer behavior or aid pricing decisions, causing personas to be underutilized or outright ignored. The process of developing personas via proper customer segmentation desperately needs to improve.

Customer Segmentation is the Foundation of Modern Marketing

Segmentation, Targeting, and Positioning (STP) are the pillars of modern marketing. Unfortunately, segmentation is one of the most talked-about and yet misunderstood and misapplied concepts in all of marketing. The core truth is that your customers are heterogeneous. Customers are in different situations leading to different needs and levels of perceived and realized value from your SaaS product. If you try to build a single product for everyone, you are very unlikely to succeed.

If you’re not thinking segments, you’re not thinking.

Theodore Levitt, Marketing Imagination

The essence of customer segmentation is to create marketing offers and communications relevant to each customer situation while still allowing the company to manage these diverse needs in a scalable way. There is no individual company that looks like your “average customer” across all dimensions. Do not be seduced by your averages.

This post will not be covering Targeting or Positioning, as those happen later in the pricing strategy process and merit extensive discussions on their own. There are already too many clickbaity posts on “How to Create your Ideal Customer Profile” trying to jam this nuanced topic unsuccessfully into a single post. But stick with me; we’ll get there. Moving on.

Customer Segmentation and SaaS Pricing

Segmentation is the cornerstone of SaaS pricing and is the starting point for devising a solid SaaS pricing strategy. However, most companies focus on segmentation approaches that do not effectively differentiate customers by purchase drivers or classify them in a helpful way for informing pricing decisions. When considering pricing, failure to segment properly leaves you at risk of losing profits by failing to price according to value, thereby undercharging some segments and losing others entirely by outpricing them.

But First, Beer

To give a better sense of why segmentation matters to pricing, let’s use a simple example. Most of my clients start thinking about pricing by considering the right price level (i.e., price point). So what is the right price for a simple, beloved consumer good – a can of beer? $1? $2? It turns out, without thinking about customer segments (and their different contexts) first, you end up without a defendable answer.

At the grocery store, you can purchase a can of beer for $1. But at a bar, that same can of beer is going to be $5. And at a music festival, that beer will be $10 or more (although they will sell you the “tall boy” so you feel better about your big purchase)!

So what is the cause of this pricing differential? You’ve got several factors to consider – customer context, customer willingness to pay (driven by customer need), and relevant competitive alternatives. Notice that you are the same in every one of those contexts, a successful, 35-year-old Silicon Valley CEO with 2.5 children and a Stanford CS degree. (I forgot devilishly handsome, but you knew that already.) However, those personal details were irrelevant to the price you would pay in each of those situations.

I’m sure your SaaS product is much more complicated than beer. With this simple example, you can see how confusing this situation can become if you haven’t thought about your customers’ different contexts, willingness to pay, and relevant competitive alternatives well before discussing price levels.

Most SaaS executives think that what you charge will determine your success. In fact, who and how you charge determines your success. Segmentation is the first step to SaaS pricing success.

Challenges and Goals of Customer Segmentation

So now that you understand why segmentation is so important, you may have some questions before proceeding. Naturally, some common questions arise when segmenting customers:

- What variables should I use for segmentation?

- How narrowly should I segment my customers?

- Will segments remain stable over time? Will I have to re-do my segmentation?

- How actionable and understandable is my segmentation?

The answers to these questions are highly dependent on both the base variables chosen for the segmentation and the method used to derive the customer groups. This post will focus on the base variables, and my next post will dive into segmentation methods.

The Five Criteria for Effective Segments

Ultimately, the goal of effective segmentation is to divide your market into groups that share common criteria within a group but have differentiated buying behaviors between groups. When determining if derived segments are “good,” use the following criteria:

- Identifiable: Segments are recognizable from available, observable data.

- Differentiable: There are apparent differences in responsiveness (i.e., heterogeneity) to the marketing mix (including price) between segments, but homogenous responsiveness within a segment.

- Viable: A segment is large enough to warrant the company’s attention (e.g., current # of prospects, economic benefits, future growth potential), and the company expects the segment to be stable over time.

- Understandable: A segment makes intuitive sense to the business stakeholders outside of mathematical models. Pro Tip: A good test for this is asking your sales team to identify their customers by your segmentation scheme.

- Actionable: Segments attached to profiling data are reachable and permit differential actions. Using the beer example earlier, the order of magnitude price differential between the grocery store and the music festival is because there is an enforceable price fence (and usually a physical one at that) preventing the music festival participants from running to the grocery store between acts.

Categories of Variables Used for Customer Segmentation

It’s essential to choose response variables that are stable over time and drive differences in purchasing behavior. However, managers face many attributes that they can use for segmentation, the most common of which are poor predictors of willingness-to-pay and likelihood-to-buy. To reduce the complexity of this decision, we want to create a framework to understand possible variables and how to choose among them.

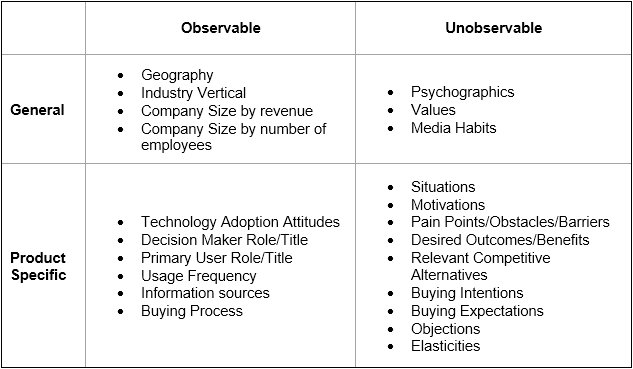

Wedel and Kamakura outlined a handy data categorization method that I will use here to help make sense of the variable choices available:

- General vs. Product-Specific Variables: This categorization distinguishes between customer variables that are stable across all products versus variables that change by product category. Customers are not blindly consistent in purchasing behavior across product categories. This varied behavior is exacerbated in a B2B context when different departments (and thus different individuals) may be responsible for buying various products. Also, the diffusion of purchase authority has become more relevant with the move to SaaS, as purchasing or implementation decisions no longer involve a centralized CIO/IT decision-maker.

- Observable vs. Unobservable Variables: These are customer variables that you can determine externally via third-party sources (e.g., Crunchbase, Pitchbook, CIA Factbook) versus those requiring primary research or direct validation.

The table below outlines the most commonly used variables for B2B customer segmentation sorted into these categories. I’ve provided a glossary of definitions at the end of the post for some of the less well-known variables. Some data may span or change categories depending on product or situation, but this will generally hold for this discussion.

Deciding Which Data to Use: A Five Part Test

To weigh our choices of variables against each other, managers should consider the following five criteria:

- Does the variable create segments that match our “Criteria for Effective Segments” outlined above?

- Is the variable relevant to the task (i.e., making pricing decisions)?

- Is the variable well-defined? In other words, is there a broad consensus on the meaning and the levels?

- Is the data available?

- How much does it cost to get the data?

The Bad

Many firms opt for variables that don’t meet the above criteria, which will result in poor segmentation (and those useless personas). These variables include firmographics (geographic, company size, and vertical), psychographics, values, media habits, technology adoption attitudes, and information sources. Multiple studies have shown that these variables perform poorly in creating segments that meet our criteria for effective segments and, therefore, will not give you valuable results.

The Good

The most critical and valuable variables for segmentation in the context of pricing are:

- Situations

- Motivations

- Pain Points/Obstacles/Barriers

- Desired Outcomes/Benefits

- Behavioral Intentions & Expectations

For those of you familiar with Jobs-to-be-done (JTBD), you may recognize the above list. Jobs-to-be-Done is a perfect tool to use for pricing segmentation. At some point, I’ll do in-depth posts on two foundational JTBD books (Competing Against Luck and What Customers Want), but for now, I’ll just recommend those books to you if you want to understand JTBD in more detail.

I have found Tony Ulwick’s focus on customer outcomes most useful for a segmentation exercise for pricing, as multiple studies have found customer value to be one of the most robust dimensions by which to segment customers. I encourage you to focus on outcomes vs. customer needs or benefits because, as Ulwick points out in What Customers Want, “needs,” “requirements,” and “solutions” are generally too ill-defined to be used as inputs to the process. Benefit statements like “faster,” “easier,” “better,” or “cheaper” can mean drastically different things depending on the customer and context. Finally, customer outcomes tend to be stable over time, satisfying one of our key criteria for effective segments.

The Problematic

I’ve purposely omitted several variables you might have expected to see. Specifically, behavioral data (e.g., product usage data), feature preference, and willingness-to-pay. These variables are problematic, at least in initial customer segmentation, for different reasons.

Behavioral Data

There are several challenges with trying to apply usage data for segmentation in a pricing context. For one, if you do pricing research before building your SaaS product (as you should), you won’t have any usage data to use. If you are evaluating pricing for an existing product, your current pricing model may bias product usage in unclear ways. This bias is a symptom of a bigger problem — your usage data will tell you, “What happened?” instead of “What should I do?”

Let’s use another simple example to illustrate: My power company, Austin Energy, currently charges me via standard utility billing. I pay more in a progressively tiered system per kilowatt-hour (kWh) of energy I use. If Austin Energy is contemplating changing its pricing model to a flat-rate model, they may look at my energy consumption in the past to figure out how much energy I may use in the future. However, a switch to a flat-rate model vs. a usage model will change my behavior. I will set my thermostat at 68 degrees in the Texas summer because it doesn’t matter how much electricity I use. In short, Austin Energy will not get a helpful predictor of my future behavior based upon past usage.

With that warning given, you should only use behavioral data to help validate results found through primary, outcome-based segmentation. Usage data is only a proxy for desired outcomes, and you’re unlikely to find a bright line in your product between disparate customer needs and the usage of one or more features.

Feature Preference

Features, like usage, are only a proxy for a customer’s anticipated benefits. You run into a significant problem when you ask participants to rank order features. The individual participant needs to understand your product and their usage context well enough to translate the feature into their benefit on the fly. This translation step is bound to muddy your research results as you depend on folks who have no context for your product to do this translation perfectly. Asking participants to translate like this has a low probability of success.

Asking for preference of features may work for highly commoditized products and features your respondents are familiar with. However, for most SaaS businesses building innovative features, it’s unlikely the data you get back will be reliable.

As an example, imagine you are buying a digital camera. You start comparing models and see that the better cameras have higher megapixels. This is a feature, right? Isn’t this a useful comparison of features? Yes, in this case, but that is only because the digital camera industry has spent massive time and money educating customers that megapixels translate into higher image quality. The “better image quality” is the true benefit here. Customers can only perform this translation step in their heads when comparing models because of this pre-existing knowledge.

How about a counterexample? Your new product is going to be best-in-class in a growing, niche market. One of the defining features of your product is more dibelkrakens (don’t Google this, I made it up) than any of your competitors. If you ask your prospective customers, “How important are dibelkrakens compared to other features?” you will get meaningless data. Your customers have no pre-existing knowledge of dibelkrakens and cannot translate this feature to an anticipated benefit.

Willingness to Pay

At a later stage, willingness to pay can be a helpful tool for additional segmentation. However, you have a bit of a chicken-and-egg problem here: You cannot get a clear read on willingness to pay until you clearly understand and communicate the solution’s benefits to your audience. When you’re still trying to figure out what different segments care about via outcomes, you are in a position where it is challenging to present a coherent definition of the value your product provides. Willingness to pay as a primary segmentation variable has similar issues to asking directly about feature preferences.

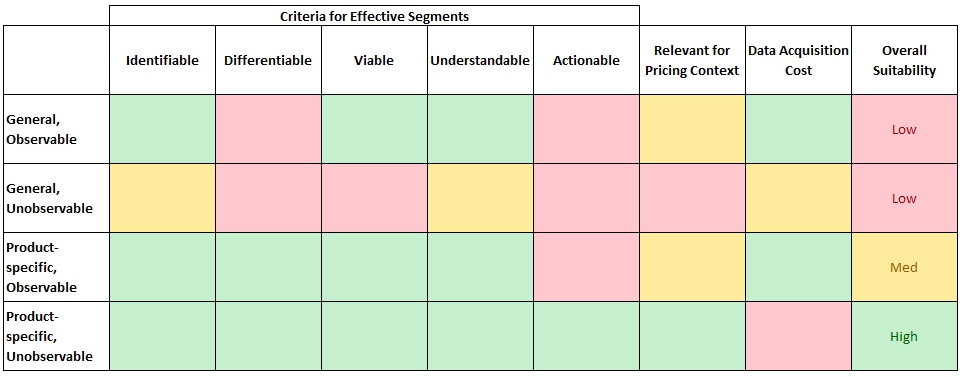

Summarizing Usefulness of Variable Categories

OK, that was a lot of information, I know. I’ve created the following table to visually represent variable categories’ suitability by the tests outlined previously.

Takeaways:

- Product-specific variables are better than General variables.

- The cost of acquiring data is higher for Unobservable characteristics than for Observable characteristics (as one might expect).

- “General, Unobservable” variables are undesirable for our purposes. I do not recommend using them for segmentation.

- “General, Observable” variables are not helpful for primary segmentation. However, these variables can be beneficial for creating those customer personas later and should be included in your research process so you can use them at the end of the process (covered more in the next post).

- The best data for segmentation lay in the “Product-specific, Unobservable” category — but naturally, this will cost the most to obtain.

In my next post, I’ll focus on segmentation methods now that I’ve spent some time breaking down the variables that feed into them. We’ll continue to explore what to do with the data you collect from them in future discussions.

Appendix: Definitions for Select Variables

- Behavioral Intentions: The degree to which a person has formulated deliberate plans to perform or not perform a behavior.

- Behavioral Expectation: A measure of an individual’s perceived likelihood of performing an act (e.g., purchase/use a product).

- Benefits: The benefits people seek in products.

- Elasticities: The relative change in demand in response to a relative unit change in a marketing instrument (mainly price). These are difficult to measure in the abstract and are not consistent across price categories for a single buyer.

- Psychographics: A qualitative breakdown of customer’s attitudes, opinions, beliefs, interests, and lifestyles.

- Technology Adoption Attitudes: Associated with theories about how innovation diffuses through a market, adoption happens in sequential stages across different customer types usually labeled as 1) Innovators, 2) Early Adopters, 3) Early Majority, 4) Late Majority, and finally, 5) Laggards.