Most SaaS leaders have never lived through sustained high inflation. With everyone around you increasing prices, it seems easy and almost necessary to do the same. Instead of following the crowd, taking a thorough approach to this situation is far better than a knee-jerk reaction.

This article covers the following:

- How a one-size-fits-all approach to customers and products won’t cut it

- How to focus primarily on value while evaluating your competition and costs

- How a well-planned execution can make all the difference

Let’s get started.

The last period of sustained high inflation in the US was the 1970s, peaking at 13.5% in 1980. It has been sub-6% since then, so most SaaS leaders have never lived through an elevated inflationary environment. The US inflation rate is 7.7% as of October 2022 and 10.5% on average in the OECD countries.

For this article, we will focus more on the US and Eurozone and less on countries with typically astronomical rates, such as Argentina and Turkey. Unfortunately, if you’re a leader in those economies, you’re already a pro at handling severe inflation.

Labor and materials costs are rising, but SaaS companies don’t have as many variable unit costs as other industries. However, SaaS leaders aren’t in the clear completely, as wages have skyrocketed for in-demand tech workers.

Salaries increased by 6.9% YoY from 2020 to 2021. In some vital tech roles, wages have surged as much as 20% in the past two years. During this time, businesses found it increasingly difficult to fill all the positions available, necessitating significant compensation competition among firms in this war for talent.

With the increased cost of employee salaries and other business areas, SaaS companies across the board are signaling that they are raising prices due to inflation. SaaStr found that more than 50% of SaaS companies are planning to raise prices in 2023, with another 22% considering it. This situation is becoming both a self-fulfilling prophecy and an opportunity.

In some ways, an inflationary environment can make price increases easier. Your customers are mentally prepared for the rising costs across their environments. However, this doesn’t mean they will like it, as their budgets are already taking a hit with increases in overhead expenses and competitive salaries. However, they will be less surprised as other suppliers are increasing prices.

Inflation is not a blanket permission to raise prices.

Steven Forth, Ibbaka

Take this opportunity to reconsider your prices thoughtfully, but don’t just react. You can unintentionally damage your customer relationships and profits by making reactive price increases by following the SaaS crowd without careful consideration.

That said, swift action is warranted. Best to be prepared.

Avoid a One-Size-Fits-All Inflation Approach

Because your costs increased 10% in the past year doesn’t mean you should pass that 10% to your customers via price hikes across all products. Take the time to evaluate your overall goals, changes in customer perceptions, and differences across your products and customer segments before proceeding with any changes.

Evaluate Your Inflation Revenue Opportunity at the Leadership Level

Convene your pricing committee to address your revenue and profit opportunities.

In these meetings, define your price increase target and profit objectives at the leadership level. In general, the aim should be to maintain long-term profit dollars rather than to extract extra dollars from the market during this period. Break your goals down by segment, product, and channel. This analysis will help you identify potential opportunities lost by looking only at the overall customer population.

As you decide how to tackle inflation, operating profit margin (EBIT) goals will play quite an important role. Is your goal a full pass-through (i.e., where you maintain your profit margin on a percentage basis), which will increase your profit dollars? This option is usually the more difficult route than a partial pass-through, where you try to maintain profit dollars at pre-existing levels at the expense of a slightly lower profit margin. I’d advise a partial-pass-through objective, as that will result in a lower overall price increase and, therefore, an easier path for you and your customers.

See the potential scenarios in the simplified P&Ls below. On the left side, you have your “pre-inflation era” P&L (P&L 1). Following to the right, you can see alternative scenarios after inflation impacts your costs, including doing nothing (P&L 2), a partial pass-through adjustment (P&L 3), and a full pass-through adjustment (P&L 4). Note that I’ve simplified the P&L to be unit-based, assuming quantity is held constant for this example.

Review your contracts to determine which are in play in the near term. What percentage of contracts are up for renewal? What notice period do your contracts require for price increases? This analysis will give you an idea of your fiscal year’s achievable revenue and profit impacts.

Look beyond the simple answer of just raising list prices. Evaluate all areas of your revenue generation machine, such as modifying discounts, promotions, payment terms, surcharges, and service-level agreements. Can you lower the default percent discount you offer to lock-up longer-term contracts, acquire a valued customer logo, or get a customer case study? Can you add professional service surcharges, setup fees, or charge for previously free onboarding?

Don’t forget to evaluate the cost side of the profit equation. Can you recoup any increased expenses with a focus on better procurement practices? Or adjustments to hiring practices?

The pricing committee should also evaluate the potential downside of a price increase. Often fear is the dominant emotion executives experience when facing a price increase. An approach grounded in data with appropriate scenario modeling can paint the likely best and worst-case scenarios and help alleviate unreasonable fears.

Don’t Treat All Your SaaS Products the Same

Evaluate your product mix and avoid treating all products the same. As you evaluate your product portfolio, ask yourself a few questions:

- Is the demand for some of your products more inelastic than others?

- Given a specific product’s unique characteristics, do you have higher or lower pricing power?

- Does one of your offerings serve as a low-cost foot in the door for bigger deals?

- Are some of your products at the end of their lifecycle?

- Is there an opportunity for higher percentage price increases on your lowest average selling price (ASP) products?

Let’s explore a few of these areas briefly.

Foot-in-the-Door Products

If you have a low-cost product or offer that gets a customer in the door, consider minimally increasing the price or not raising the price at all. SaaS companies often use these products as a gateway for accelerated customer acquisition and future expansion revenue. For example, in September 2022, Slack increased its Pro plan from $8 to $8.75 per user per month. The company didn’t raise prices for its Business+ or Enterprise Grid plans, though it did expand access to new features for free users, as well as simplified usage limits.

Products Nearing End-of-Life

What about those products at the end of their lifecycle? Price increases on these products may be more justifiable, given your desire to retire them sooner or the continued maintenance costs of legacy customers. For example, you may have limited engineering capability to update and maintain the code for a legacy product. A price increase helps you justify continued investment in product maintenance for the legacy product vs. other products in your portfolio.

Low ASP Products

It might be easiest to increase the customer price on a low ASP product on a percentage basis. For example, if one add-on package is $5 per month, increasing this cost by a dollar is a 20% price increase. This increase will seem less dramatic than one on a higher-priced bundle with a current list of $100 that would need to increase by $20 for the same percentage gain. Make sure to analyze your whole product portfolio, as your lowest ASP product could be an add-on product, which might be best suited for a price increase.

Don’t Treat All Your SaaS Customers the Same

After you review your product portfolio, it’s time to examine your customer segmentation. What are your customers’ varied situations? Don’t treat all customers the same, as some segments are more apt to support a price increase than others. The value your product provides will vary depending on the customer segment. Customers that receive disproportionately more value are likely more amenable to price increases.

Ask these questions about your customer segments to determine ways you might approach the inflation problem differently:

- How will inflation impact your customers’ businesses? Is this the same across segments?

- Are some of your customers more price sensitive than others?

- How long have customers been with you?

- Are there customers on old, grandfathered plans? Were any customers extended overly generous discount terms?

- Will you handle new prospects differently from existing customers?

- Will you phase the changes in or do it all at once?

Let’s discuss some of the specific approaches in more detail.

Grace Periods, Discounts, and Grandfathers

Consider giving current customers a temporary discount to smooth the transition or give them time to upgrade at your current cost before increasing rates. For example, Webflow announced a price increase in September 2022. The company stated that existing customers on legacy pricing have a grace period until September 2023, and new customers can purchase or upgrade at legacy rates until the end of 2022.

When we talk about “grandfathers” here, I’m not talking about Grandpa Ben. For customers you extended grandfathered pricing terms or overly generous discounts on initial purchases, you need to figure out how far they have deviated from your current list prices. If you can true up those customers to your current rates (i.e., not your potential price increase), you can achieve some of your profit opportunity goals with a lower price increase in other areas.

How Has Inflation Impacted SaaS Customer Preferences?

Inflation can affect customers’ relative importance on product attributes and value drivers. For example, have emotional drivers (e.g., safety, peace of mind, access to expertise) become more critical than functional/economic drivers (e.g., increased revenue)?

Has the relative importance of functional value metrics shifted? For example, are customers now more concerned with cost control than revenue growth? Is increasing optionality more critical in this environment? For example, customers may have a higher WTP for shorter-term contracts because of perceived future cash flow risks. Or have interest rate changes increased the importance of Operating Capital value metrics?

These considerations help you evaluate how you might change your value communication to decrease price sensitivity. These changes may dampen overall churn or the impact of pricing or packaging changes.

Focus on Value. But Don’t Forget Your Competition and Costs

A cost-based rationale for increasing prices is part and parcel of a cost-based pricing orientation. Although costs and competition are essential to the pricing process, you should focus primarily on value.

Adjust Your SaaS Value Levers

Value is the most important aspect of pricing, but it’s a vague concept many struggle to understand, let alone implement in their pricing process. Let’s discuss ways to add value to your products that will help you increase revenue and profit.

Create a New SaaS Product

Is there a new product you are missing in your portfolio? For example, is there a high end of the market that you are undeserving with your current products? A new product will increase overall customer value and spending.

Modify Your SaaS Packaging

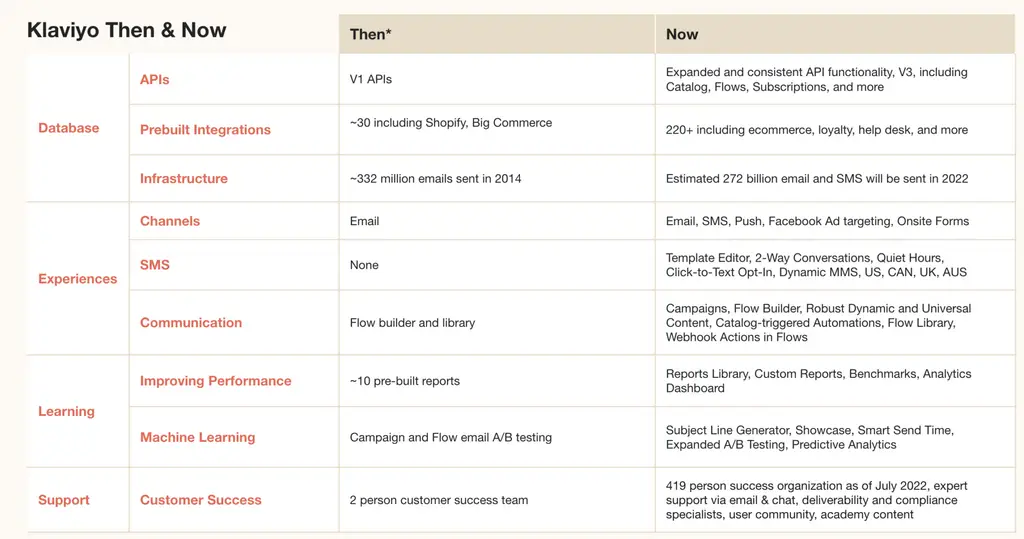

Another way to increase value while bumping up the price is to change the packaging. You might have a few tiers in a Good-Better-Best configuration, like Basic, Premium, and Pro. The idea is to create different feature mixes for your bundles or brand-new ones (like Starter, Growth, and Enterprise) at higher prices. For example, when Klaviyo announced its price increase, it highlighted the changes to its current tiers and introduced a new tier called Klaviyo One.

You can also create usage caps or minimum units for existing bundles that force upgrades to higher tiers. For example, you can adjust the maximum allowable units (e.g., users, devices, storage) for a given tier.

As part of this feature remix, you also can unbundle some features and directly monetize them as add-ons. Use product analytics to determine feature adoption and usage by segment. Choose one or more features to unbundle that are only used by a small subset of your customers but are highly valued by those customers.

Improve Upsell Pathways

Consider improving your upsell pathways. For example, grease next-tier upgrades with incentives, better features, additional or improved onboarding, and Customer Success training. Additional upsell revenue is a powerful way to increase ACV. Still, you must prioritize giving your Customer Success team the proper tools to accelerate this path with a consultative approach.

Evaluate Changes to Costs and Competition

Your primary focus should be on value, but you must understand your cost drivers and competition. As I’ve mentioned, just because you’re doing value-based pricing doesn’t mean you get to ignore your costs or competition. You need to know those, too!

Assess How Inflation Impacts Your SaaS Cost Drivers

Identify your primary cost drivers. Can you negotiate your costs in these areas to lower the impact on your overall budget? Leverage procurement to work with your suppliers on your rates (Don’t forget that they are going through exactly what you are!) It also might be to your advantage to negotiate new employee salaries, which wouldn’t hurt, given the current employment market.

Are costs of goods sold (COGS) increasing across the board or only for specific features or use cases? For example, consider modifying service-level agreements that include extended support options or charging for previously free onboarding. These “features” incur a high cost of human resources to deliver. These services and agreements should be considered separately from features enabled purely by technology at a relatively lower marginal cost.

You need to understand your true cost-to-serve. Many companies can get away with a lack of cost knowledge during boom times. Now is not that time.

Keep an Eye on the Competitive Landscape

Your product exists in a broader market landscape, including direct competitors and indirect competitive alternatives. The reactions of direct competitors in the market may shift your relative price-value trade-off, price positioning, and economic value.

Ask these questions about your competition:

- What are your competitive alternatives?

- Are there viable substitutes customers are considering outside your standard competitive set? (e.g., milkshakes)

- What is your current price positioning? Has it changed?

- Are you the leader or follower in your market?

Inflation Effects May Require a Recalibration of Your Price Positioning

Evaluating your price positioning entails monitoring your perceived value-price trade-off to ensure your relative price-value trade-off hasn’t shifted unexpectedly.

Your position shifts primarily from two causes:

- One or more competitors changed their pricing. The most important of these is your Next Best Competitive Alternative (NBCA), which would then change your reference value price.

- Alternatively, your perceived value changed because of an adjustment in value drivers.

There are several reasons this reevaluation is necessary. A shift in your price positioning could spark an unintended competitive reaction. Your price position may put your competitor(s) in a value-disadvantaged position, whereby one of their only options is to lower prices. This situation can spark an unintentional price war. Second, you may leave money on the table because of increased perceived value. Finally, this exercise may force a reevaluation of value drivers across the market landscape that has you operating from a different position than you previously thought.

Are You a Leader or a Follower?

Think about your competitive standing in the market: Are you a leader or a follower?

Leaders generally move first and signal price moves in advance to encourage everyone to follow. This dynamic often means that market leaders face less risk and provide air cover for the rest of the market. Conversely, followers wait for leaders to make the first move.

Not everyone wins equally in this environment, as followers tend to grow slower than the strongest competitors.

The topic of signaling is sensitive and has significant potential legal risks. All jurisdictions prohibit active price collusion between companies, and you should work with your legal counsel to understand what is allowed (or not) before proceeding. (Note: Nothing in this post should be considered legal advice.)

Observe Your Competitors

If you don’t have a competitive intelligence process, now might be a good time to start one. Here are some things you can do to observe your competitors closely during this time.

- Listen for signaling from their CEOs in earnings calls and interviews. Or maybe Twitter if you’re competing with one of Elon’s companies.

- Pay attention to their SEC filings.

- Keep a watch on their pricing pages. Tools like XaaSPricing and Retool can be helpful for this.

The more informed you are about the current state and plans of your competitors’ pricing plans, the better prepared you will be to adapt and adjust agilely.

Agile Inflation Execution Increases the Probability of Success

Achieving a successful price increase requires well-planned execution. You will need to clearly and thoughtfully explain the rationale and the process through effective internal and external communication.

Delineate Your Inflation Price Change Rationale

Don’t just use costs to justify your price increases or changes. When you invoke costs as the reason for your price increases, you tempt a “Live by the sword; die by it” situation.

If you tell customers you are raising prices because of inflation, will customers expect you to lower prices when you enter a period of deflation?

Instead, focus on the additional value you’ve added to the product since the last pricing change. Did you add new features, improve your UX, or increase the scalability of your platform since your previous increase? These value increases should headline your communications campaign.

As I demonstrated in the partial vs. full pass-through P&Ls section above, maintaining profitability on a dollar or margin basis doesn’t require you to fully match the headline CPI inflation rate in your price increase. You can leverage this as one of the pillars of your messaging. For example, saying, “Inflation is 10%, but we are only increasing prices by 5%,” can increase customers’ perception of fairness since you bear a portion of the pain alongside them. But don’t let this cost-based reason be your only or primary reason for price increases.

Though customers might anticipate a price increase, it can still be hard to hear the news, so allow for undue hardship exceptions in customer messaging. Add language that expresses that you realize everyone is suffering from higher prices and are willing to work with customers when the price increase would create significant burdens on their business.

The trade-off of keeping a customer from churning (or in business) is probably worth the few points of revenue you’re giving up. This pressure release valve will demonstrate your empathy, and customers will, by and large, only take you up on it if they are in a pickle.

Evaluate your customer segments and determine if you need different messages for each group. For example, we previously talked about customers on old grandfathered plans. This segment will need different messaging than those with whom you extended generous discount terms or those who find more value in certain products you offer.

Develop a Rollout Plan

Once you establish your rationale and the direction of your messaging, create a rollout plan. Who gets notified and when? A/B test your message with a subset of customers so you can announce your changes in a phased approach to minimize risk and uncover unknown assumptions before you put your entire customer base at risk.

Prepare Your Sales Team With Proper Communication and Tools

Take the time to communicate and train your front-line employees. Provide support for Sales and Customer Success teams with

- Negotiation guides

- FAQs

- Talking points

- Role-playing exercises

- Competitive intelligence on competitor price increases

- Competitive battle cards to demonstrate your superior value proposition

Work with Marketing to create customer-facing materials to support the price changes, which they can post on your website, email newsletters, and social media. Help your customers to understand the changes.

Brainstorm ideas that allow the sales team to mitigate customer resistance with creative alternatives such as give-get plays and capacity upgrades. For capacity upgrades, you’re trading off something valuable to the customer but has little cost to you. Since the marginal cost of software is meager, you can offer customers additional seats (or your given price metric) at a higher price than they were paying but much less than the current list. They win because they get more capacity. You win from higher revenue and a retained customer.

Consider adjusting your sales incentives to drive rep behavior toward the targets set by the pricing committee. For example, are you now pushing a new product or offer configuration? Are you trying to increase term lengths? The more aligned your sales comp plan is with your targets, the greater your chance of success in hitting those targets.

Also, streamline two-way communication pathways within the company that help propagate prospect and customer feedback to the pricing committee. These internal communication channels can accelerate how quickly the pricing committee can react and refine your approach as you roll out the pricing changes.

Time to Execute

Before you say “go,” establish which key performance indicators (KPIs) you will track. Then monitor performance and be prepared to adjust as necessary.

Companies that track execution rigorously establish a data infrastructure that allows for a high degree of performance transparency.

McKinsey & Company, Five ways to ADAPT pricing to inflation

The OODA loop (Observe → Orient → Decide → Act) will help you think critically, anticipate threats, and offset them before they become hazardous. It will help you stay agile as you make adjustments during execution.

While you are going through refining your products’ prices, establish plans for future price increases based on inflation expectations:

- In an unpredictable inflation environment, a series of small increases are preferable to one big move. As we have seen, the overall market is struggling, so we will be here for a while. One giant leap will be much more of a shock than smaller steps.

- Build cost-of-living ratchets into your contract terms for multi-year agreements. This policy will protect you from future margin compression while being clear and transparent with customers upfront.

These practices avoid doing a giant “catch-up” increase when you’re caught flat-footed after not doing an increase in years. These small price increments and value-driven communications will help with customer retention.

A Better Recipe for Handling Inflation

Nobody likes inflation, but as business leaders, we have to deal with many things we don’t like, which aren’t our fault. However, with a thoughtful and well-executed strategy, you can be prepared and shield your company from the full brunt of inflation’s impact.

Sustained high inflation in developed economies hasn’t happened during the lifetime of most current SaaS leaders. A thoughtful response to the matter is preferable to a snap decision from inexperience.

Don’t take a one-size-fits-all approach across customers and products. It doesn’t make sense as you likely have products with different value propositions and pricing power that serve different customer segments. A singular approach will end up harming your profits.

Prioritize value while keeping an eye on costs and your competition. You can create new products, revise your packaging, and improve upsell pathways. Simultaneously, seek to understand your true cost-to-serve and price positioning and keep an eye on the competition.

Take time to refine your rationale and plan marketing messaging. Train your employees to deliver this message effectively.

A well-planned execution of your changes can make all the difference.

Want more B2B SaaS pricing and packaging insights? Follow Dan on LinkedIn and Twitter.